Are EU card issuers CBPR2 compliant?

Banks & Fintechs continue to struggle with implementing EU Cross Border Payments Regulations (EU2021/1230). This is increasingly problematic as travel card spend has recovered faster than expected and is already outpacing pre-pandemic levels of spend. As a result, European consumers continue to get inaccurate or incomplete information about the cost of transactions in different currencies.

EU2021/1230 (CBPR2) requires Issuers to provide greater transparency on the cost of cross-currency spend on cards. Under this regulation, all EU Issuers must display the cost of a cross-border card transaction as a % difference to the most recent ECB reference exchange rate for that currency pair. This calculation must include any related costs or charges and FX rate mark-ups. This information should be available to a customer before they make a transaction (via a publicly available forum such as a website) and immediately after a qualifying transaction (via an electronic message such as an SMS or an email).

Cost Transparency Before a Transaction

The first phase of the regulation (in force since April 2020) requires Issuers to make the relevant calculation available to their customers on a publicly available forum for all relevant currencies. In practice, this requires Issuers to present the cost of cross-border card transactions in all EEA currencies, with separate calculations required for products on different card schemes or where the account is denominated in a different currency. This requirement offers cardholders the ability to understand the approximate cost of a cross-border card transaction before they spend and compare those costs to other providers.

Our research finds that compliance with this regulation remains inconsistent both between markets and within markets. In some countries, compliance with this aspect of the regulation was as low as 10% with many Issuers offering either incomplete or inaccurate cost comparisons. In addition, we find that several Issuers are professing compliance by providing cardholders with the necessary cost components to calculate mark-ups by themselves. This is not consistent with either the spirit or requirements of the legislation.

The example below highlights the differences between European Banka that are compliant and non-compliant. The non-compliant example is so as it directs its customers to the relevant MasterCard and ECB websites for cardholders to calculate the currency conversion fees themselves. The compliant example below presents a “best-in-class” model of compliance as it presents both current and historical information on their currency conversion fees, along with providing the ECB rate.

Cost Transparency After a Transaction

The second phase of the regulation requires issuers to communicate the actual currency conversion costs charged to a cardholder for a transaction by means of an electronic message (such as an SMS or email). This should be sent immediately after a relevant transaction has been authorised (with a relevant transaction defined as the first transaction in each EEA currency each month). This phase of the regulation is intended to provide cardholders with a real-time view of their actual cross-border card payment fees, directly after having made a transaction.

Our research again finds that compliance with this regulation remains inconsistent both between markets and within markets. One of the key challenges in this phase of the regulation is Issuers sending inaccurate information to customers. This is particularly problematic given the immediacy of the information provided to all relevant customers.

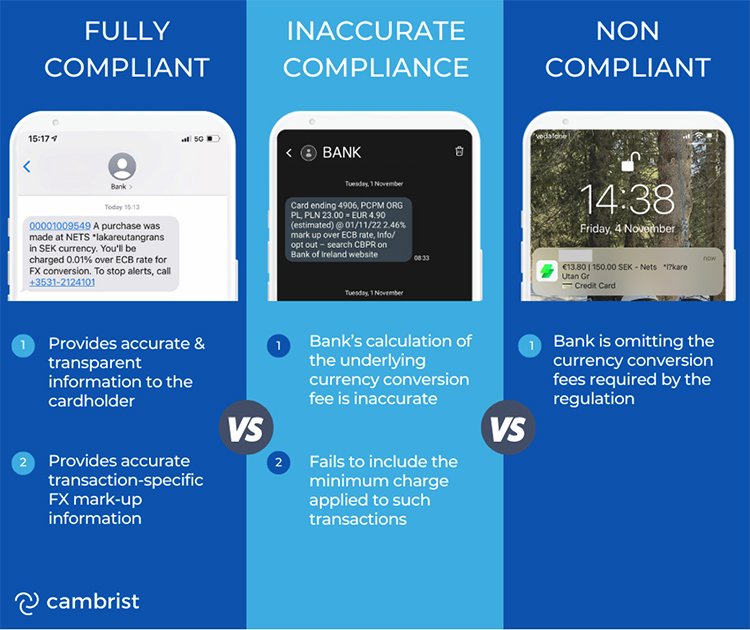

The examples below demonstrate various banks’ approach to the regulation. Where fully compliant, an electronic notification is used by the bank to provide the cardholder with accurate transaction-specific FX mark-up information. When inaccurately compliant, the bank’s calculation of the underlying currency conversion fee is inaccurate (actual charge should read 1.8%) and fails to include the minimum charge applied to such transactions (the correct currency conversion fee should be disclosed as >20%). Lastly, where non-compliant, the bank provides the cardholder with transaction information but omits the currency conversion fees required by the regulation.

The slow adoption and implementation of CBPR2 means that the regulation has not yet resulted in increased transparency in European cross-currency card spend. The European Commission are monitoring current compliance levels amongst card programmes. It is vital for issuers to become CBPR2 compliant to avoid enforcement action and to provide a transparent service for their customers.

About Cambrist

Cambrist is a leading supplier of technical solutions for the CBPR2 regulations. Our software is powering the compliance efforts of >100 card programmes, across more than 12 countries, with electronic messages distributed in 8 languages for both Bank and Fintech clients. Contact us if you would like to learn how Cambrist can support you.