Are European Issuers compliant with CBPR2?

The Cross Border Payments Regulation 2 (EU2019/518, now superseded by EU2021/1230) is designed to increase transparency in the cost of cross-currency spend on cards. Five months on from the full implementation deadline, we have taken a look at how fintechs and banks have approached these requirements for their card programmes and whether they are delivering on these transparency goals. We are aware that the European Commission are actively reviewing compliance and enforcement actions with national regulators, so compliance is becoming increasingly important.

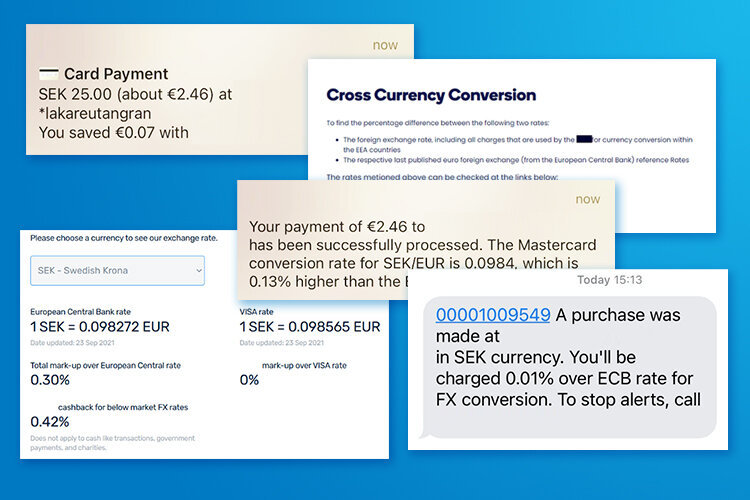

April 2020 Requirements – FX Rates displayed on a website

Since April 2020, card programmes have been required to display their total cross-border fees expressed as a percentage markup to the ECB reference rate for the prior day on a publicly available website. The website requirement offers cardholders the ability to understand the approximate cost of a cross-border card transaction before they spend and compare those costs to other providers. Our research finds three distinct categories of compliances for this requirement:

1. Non-Compliant

The first category includes Banks and Fintechs which have taken no action to meet the CBPR2 requirement. Non-compliance is particularly common amongst Fintechs where we’ve found significant levels of non-compliance. Regulated Issuers in this category need to take immediate action as the website requirement is easy for regulators to verify.

2. Partial compliance

The second category includes Banks and Fintechs which have approximated compliance by providing cardholders with the necessary cost components to calculate mark-ups by themselves. Partial compliance often requires cardholders to make complicated calculations to understand the underlying currency conversion fee and generally fails to achieve the increased transparency intended by the regulation.

The example below highlights a prominent European Bank that directs its customers to the relevant MasterCard and ECB websites for cardholders to calculate the currency conversion fees themselves.

3. Fully Compliant

The final category represents card programmes that are delivering transparency to their cardholders by effectively displaying the information on their website as required by the regulation.

The example below presents a “best-in-class” model of compliance. This German Fintech Credit Card provider presents both current and historical information on their currency conversion fees.

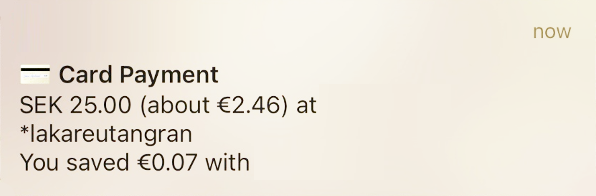

April 2021 – Transaction-specific electronic FX notification

The second phase of the CBPR2 regulation came into effect in April 2021 and requires card programmes to communicate the actual currency conversion costs charged to a cardholder for a particular transaction via an electronic message (such as an SMS or email). Phase 2 of the regulation is intended to provide cardholders with a real-time view of their actual cross-border card payment fees, shortly (if not immediately) after having made a transaction. Our research again finds three categories of compliance for Banks and Fintech issuers:

1. Non-Compliant

As per the 2020 requirements of the regulation, the first category includes Banks and Fintechs which do not provide any electronic messaging, pursuant to the regulation. We expect these Issuers will face enforcement action in 2022 unless the non-compliance is addressed.

The example below highlights a major European Bank providing the cardholder with transaction information but omitting the currency conversion fees required by the regulation

2. Inaccurate Compliance

The second category includes Banks and Fintechs which are sending electronic messages for cross-border transactions; however the currency conversion cost information is inaccurate or incomplete. Inaccurate information is particularly problematic as providing it undermines the purpose of the regulation.

The example below shows the information provided by a major European Bank for a recent transaction. The Bank’s calculation of the underlying currency conversion fee is inaccurate (actual charge should read 1.8%) and fails to include the minimum charge applied to such transactions (the correct currency conversion fee should be disclosed as >20%)

3. Fully Compliant

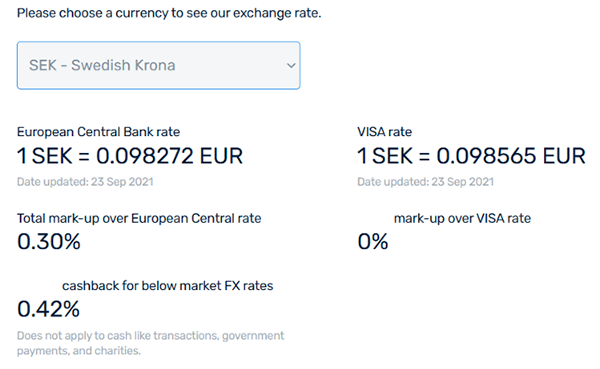

The final category includes a large number of European issuers which are fully compliant and are providing accurate & transparent information to their cardholders.

The example below shows the electronic notification used by a European Bank to provide the cardholder with accurate transaction-specific FX mark-up information

The slow adoption and implementation of CBPR2 means that the regulation has not yet resulted in increased transparency in EEA cross-currency card spend. The European Commission is due to publish a review of the regulation’s efficacy in April 2022 and it is actively reviewing results, including current compliance levels amongst card programmes. Furthermore, national regulators are being encouraged by the ECB to implement enforcement action preparation for the formal review. The results of the review will steer the next round of regulation, associated requirements, and enforcement actions. The inconsistencies in interpretation and implementation will be addressed by the Commission and regulators.

Want to read more?

We recently surveyed a sample of banks and fintechs to review compliance to phase II of the regulation, you can read the details here.

About Cambrist

Cambrist is a leading supplier of technical solutions for the CBPR2 regulations. Our software is powering the compliance efforts of >100 card programmes, comprising more than 25 pricing strategies, with electronic messages distributed in 8 languages for both Bank and Fintech clients. Contact us if you would like to learn how Cambrist can support you.